Commercial real estate index dips a little

- Details

- Published on Wednesday, 25 February 2015 17:12

- Written by PRNewswire

Amid continued strengthening in commercial real estate markets — attributable to broader economic improvement and strong capital availability — The Real Estate Roundtable's latest quarterly "Sentiment Index" dipped slightly in the first quarter, the Roundtable announced.

The dip came as survey participants expressed concern about typical cyclical issues; an array of international, homeland security and interest rate risks; and pro-labor policies that could hurt job growth.

"On the one hand, conditions for commercial real estate are quite good — and getting better — driven by improved job growth across the economy, improved business demand, and strong capital flows, as well as appropriate levels of construction and lending in key sectors," said Roundtable President and CEOJeffrey D. DeBoer. "The enactment of Terrorism Risk Insurance Act (TRIA) legislation inWashingtonlast month was also a huge relief, averting the threat of a real estate credit crunch and resulting downstream impacts on the economy."

At the same time, DeBoer said, "Q1 survey participants expressed concern about global instability, rising terrorist and cyber threats, falling oil prices, potential future erosion of underwriting standards, and what one respondent called 'unprecedented attacks' on businesses through pending labor regulations." This includes National Labor Relations Board (NLRB) rules affecting franchise operators (including hotel owners) and the so-called "quickie elections" ruling, which leaves businesses with almost no time to counter a unionization campaign on their premises.

Potentially higher interest rates are also of concern, particularly if they rise without sufficient job growth or demand, which influence net operating income, property values, and owners' ability to service existing debt.

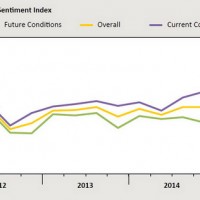

At 72 points, the "Current" index is up significantly from its historical lows of 58 points in Q4-2011 and 63 points in Q3-2012. Yet, the latest score is down two points from the 4thquarter of 2014, and is accompanied by softening in the "Future" and "Overall" indices. The Future index, now at 64, continued its recent slide from 65 in the 4thquarter of 2014 and 67 in Q3. There is now an 8-point spread between the Current and Future indices —nearly the widest since the survey was launched in 2009.

Importantly, "non-gateway" markets are increasingly benefiting from strong capital flows into top markets — helping to broaden the recovery and strengthen property values (which plunged by as much as 50 percent in some areas during the financial crisis and recession). Yet, some respondents also spoke of secondary and tertiary markets still "muddling along" — particularly in areas whose economies are tied closely to oil prices.

Underscoring the nuanced quality of the survey responses, some noted better balance now between supply and demand (as compared to the pre-crisis period) — along with less leverage and more "disciplined" lending. However, others warned about the potential for "excessive leverage by yield-starved, undisciplined" investors.

Data for the Q1 survey was gathered in January byChicago-based FPL Associates on The Roundtable's behalf. For the full survey report and The Roundtable's 2015 policy agenda (Next: Real Estate's Policy Agenda for a Sustainable Economy), visit us online atwww.rer.org.